It is time. Are you considering your business expenses for 2021?

As I sit here working on year end projections and sales goals, —and expense evaluation–one of the areas that gives me the most pause is insurance. It has gotten to where you need a degree to understand it all. And dang it – I am way more savvy than many small business owners yet insurance is vexing.

Workers Comp insurance is one of the least understood types of insurance

Sure you know about it and what it does- but many think “it does not apply to me”. You may think, I am too small or – It does not apply to me because I am a solo designer and work from home. Do not think this. You are liable for your employees or yourself if you get hurt on the job. And if you are working and earning money- you need to read this. It is a piece of the insurance puzzle that can wreak the most havoc to your business if you do not have it and need it.

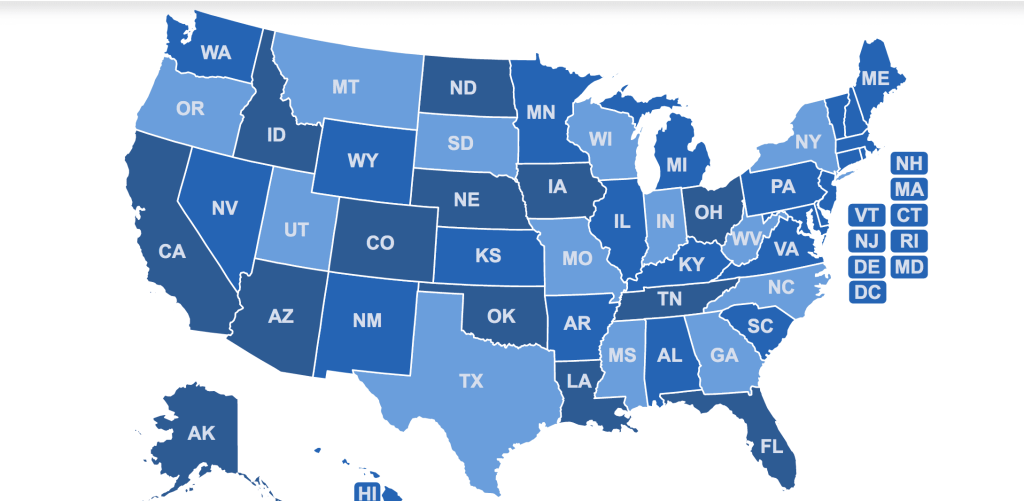

Not all states are equal

Workers comp insurance is required in the state of Florida if you have 4 or more employees but is smart to have regardless and many states require it even with one employee. The federal government does not control workers compensation insurance. It is controlled at the state level. And the cost of living, history of claims and more can affect rates you pay for workers comp insurance in your state.

Check your state–see bottom for links.

Why is worker’s comp insurance important even if you have one employee?

“It protects your business. Workers’ compensation insurance helps businesses avoid the real cost of an employee’s medical expenses and lost wages following a workplace injury or illness. Without workers’ compensation coverage, the medical expenses associated with even one major workers’ compensation claim could cause irreparable financial harm.”

But be careful when selecting agents for workers comp insurance

Here is the thing though–when you get quotes–they rarely will ask you enough questions to determine the proper codes. This makes a BIG DIFFERENCE IN WHAT YOU PAY. For example a few years ago, we discovered a new insurer coded ALL of my people as retail NOC ( not otherwise classified) and for Florida this rate is 10 times more than clerical –there is no code for interior designers I found except in Texas.

Now if your team member goes out to someone’s house and climbs on ladders–this is NOT clerical. And if you make a claim you can get denied for this if found they are climbing on ladders as a regular thing. It must be accurate but since it is a bit subjective you need to be sure and do your OWN research.

Even retail is crazy as there is nothing for small shops like ours that does not have a lot of walk in traffic–so my retail person has to be retail NOC which as you can imagine NOC means a catch all and of course is higher than some others because of that–really not very fair.

Class codes vary by state and rates vary A LOT by state

Moral here is to check your state and check the classifications carefully. Only Texas had an interior design category. And be honest with what you do as we all do different types of work. You do not want to be dishonest asa claim can be denied.

Here is a link to check your state rates by classification.

A simple comparison to illustrate how workers comp insurance rate classification can cost you money

For two employees earning 100k in income—if they are retail they are classified in one of the retail categories. But sometimes it is hard to find one that fits you so you get Retail NOC. Now remember some states will differ but in Florida that is what it would be for us–until I now have found retail-drygoods which better fits us and is 1.36 vs 1.56 per 100.00 of income–But if they classify your entire business as retail—whoa.

To see for yourself–take the income and divide by 100 and then multiply by the rate.

$100,000 IN SALARY/100.00 = $1000 X (THE RATE) OF RETAIL NOC 1.56= $1560 PREMIUM ( WITHOUT OTHER DEDUCTIONS)

$100,000 IN SALARY/$100,000=$1000 X ( THE RATE) OF CLERICAL ARCHITECTURAL 0.120= $120

$1560 VS $120–IF YOUR PEOPLE DO MOSTLY CLERICAL –WHO WANTS TO PAY THOSE RATES???

And for interior designers, there is no one category I can find that covers all of what we do.

Key take aways when considering workers comp insurance for small businesses

You think you may not need this–think again–every state is different and many require it with ONE employee.

And if you want to be exempt yourself in most states you must file for this. You do in Florida–ask me how I found this out years ago—when I got a big fat bill.

Understand you are responsible for an employees injuries or urgent care etc regardless if you have workers comp or not.

This means if you do not have it–you are still on the hook. If your employee gets hurt, either you are going to cover their expenses or the insurance will cover it if you have it. I would not take this chance regardless if “required” to have it or not in your state.

You may think you do not need it if you use only 1099 employees–not necessarily.

I see way too many designers and so called experts tell designers oh hire them as 1099 and save money. There are serious rules for this and most do not know them. If you are found out or that 1099 employee who is not meeting the requirements gets hurt and decides to sue you, you can lose your business- scary right?

And it has happened. You must protect yourself carefully and if they do not meet the requirements for 1099 status do not not not do it. The risks are great if the person decides they are not being fairly treated or they do not want to pay their own self employment taxes. You just never know so follow the rules here.

Do you ask for proof of insurance from your 1099 people? Your VA’s? You should. This would be one way for you to be sure they will not come back on you. In truth, we get copies of workers comp insurance from every sub we even recommend to a client.

Do you hire other subcontractors in your business?

If so damn well better make sure you get their liability and workers comp insurance and a w9 from them showing how you pay them. Most states will want to know in your workers comp application if you hire subs and if so may want proof of insurance or they will come back to you and include them in their calculations. Each year most companies will do an audit and you must show proof of payroll and pay the difference or they will adjust and pay you back if less than projected. Not all states work the same but this is the way it is in Florida.

Do not trust any agent–even the good ones-look for yourself or ask for a report stating exact classifications not just a premium quote. There are literally hundreds and hundreds of classifications.

Nothing against good agents but for years I did not have a good one resulting in all of my team being classified as retail–they asked me a few questions and I told them the truth–but since no classification for interior design we were classified as retail before we even had retail! This was many years ago but it still makes me mad.

Do not accept what they tell you if you find a better classification that fits your business.

This is not as hard as it seems. Know what you are looking at before you get quotes. Best advice ever on this subject!

Do not assume your health insurance will cover you if you are exempt- it may not.

Seriously. This could be disastrous. I opt out and am excluded but I also can afford to self insure myself so prefer the savings. Some of you may not be able to do this. And trust me the health insurance companies will ask–have had it happen to me when I tripped a few years ago on my business property but before I had gone in to work.

Talk to your attorney, talk to your health insurance provider–ASSUME NOTHING about this as it is an inexpensive policy for most people–we pay around $1000 to $1500 a year and worth it.

This is the type of “overlooking” that can tank your business and you do not have to be a large firm to lose out. If you are a sole proprietor then you are taking your business “life” into your own hands by being completely liable personally and this is a mistake.

Other links that may be helpful:

https://smallbusiness.chron.com/business-owner-workers-comp-65673.html

To learn more about running your business (not letting it run you), check out our courses and coaching services through The Design Paradigm and The Paradigm Shift! For more Cherylisms & honest talk, join our exclusive Facebook group “Small Business Think Big“.

Please check out our best program! Learn how to navigate flat fees, our complete visual proposal and how to make a win win for you and your client.